Minnesota Sales Tax Calculator

Sales Tax Rate Calculator | Minnesota Department of Revenue

Sales Tax Rate Calculator. Use this calculator to find the general state and local sales tax rate for any location in Minnesota. The results do not include special local taxes—such as admissions, entertainment, liquor, lodging, and restaurant taxes—that may also apply. For more information, see Local Sales Tax Information .

https://www.revenue.state.mn.us/sales-tax-rate-calculator

Minnesota Sales Tax Calculator - SalesTaxHandbook

The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Minnesota has a 6.875% statewide sales tax rate , but also has 274 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 0.521% on ...

https://www.salestaxhandbook.com/minnesota/calculator

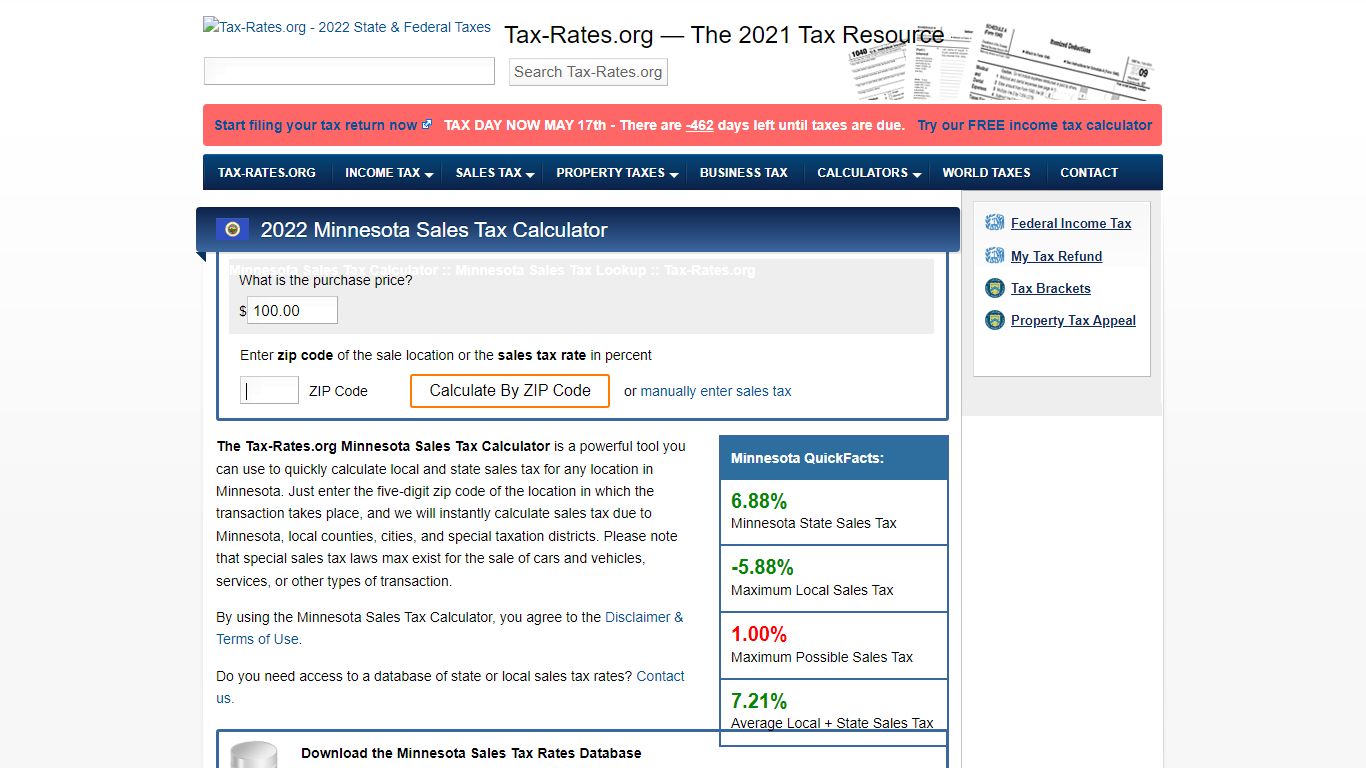

Minnesota Sales Tax Calculator - Tax-Rates.org

Minnesota State Sales Tax. -5.88%. Maximum Local Sales Tax. 1.00%. Maximum Possible Sales Tax. 7.21%. Average Local + State Sales Tax. The Tax-Rates.org Minnesota Sales Tax Calculator is a powerful tool you can use to quickly calculate local and state sales tax for any location in Minnesota. Just enter the five-digit zip code of the location in ...

https://www.tax-rates.org/minnesota/sales-tax-calculator

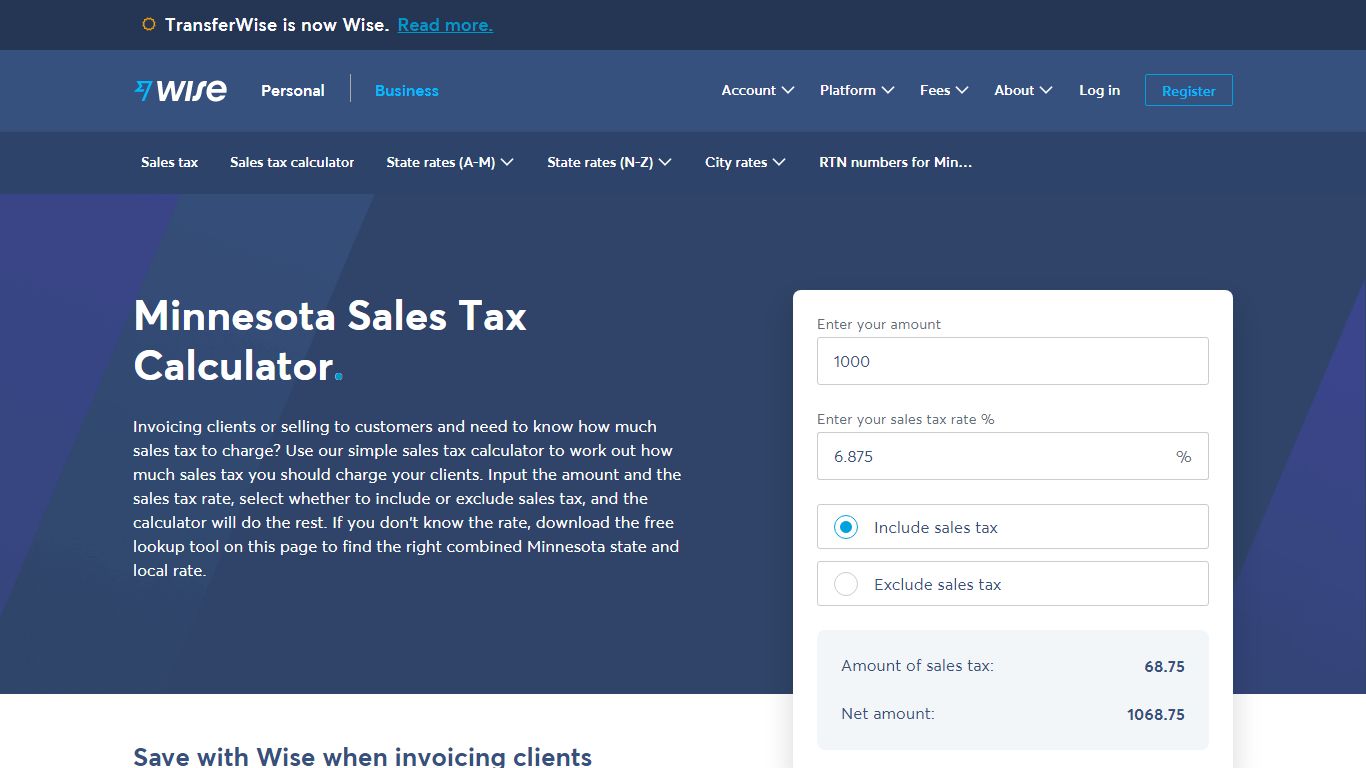

Minnesota Sales Tax | Calculator and Local Rates | 2021 - Wise

Local tax rates in Minnesota range from 0% to 1.5%, making the sales tax range in Minnesota 6.875% to 8.375%. Find your Minnesota combined state and local tax rate. Minnesota sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a headache.

https://wise.com/us/business/sales-tax/minnesota

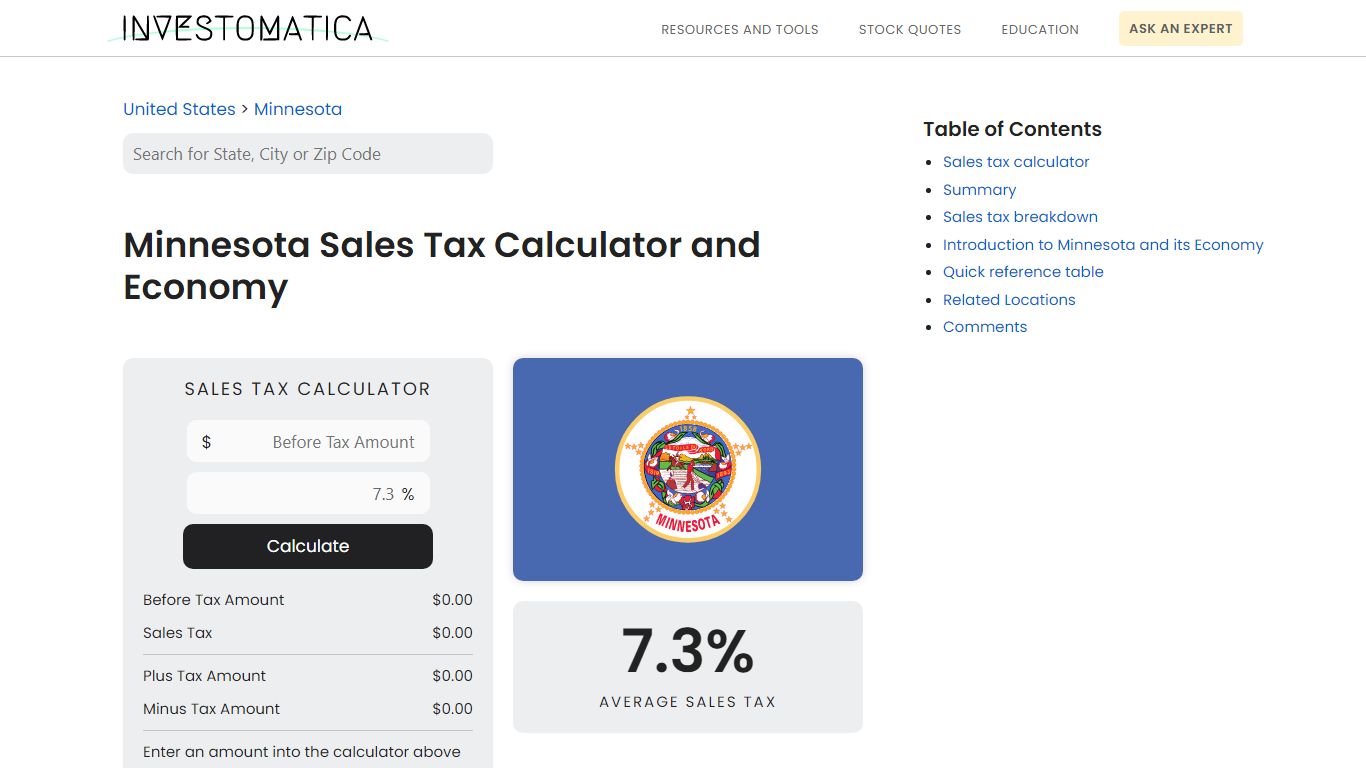

Minnesota Sales Tax Calculator and Economy (2022)

Sales Tax Table For Minnesota. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 7.3% in Minnesota. All numbers are rounded in the normal fashion. To calculate the sales tax amount for all other values, use our sales tax calculator above.

https://investomatica.com/sales-tax/united-states/minnesota

Sales and Use Tax | Minnesota Department of Revenue

Cannabinoid Products and Sales Tax All cannabinoid products that contain CBD or THC are subject to Minnesota sales tax. COVID-19 and Telecommuters From March 13, 2020, to June 30, 2022, Minnesota will not seek to establish nexus for business income tax or sales and use tax solely because an employee is temporarily telecommuting due to the COVID ...

https://www.revenue.state.mn.us/sales-and-use-tax

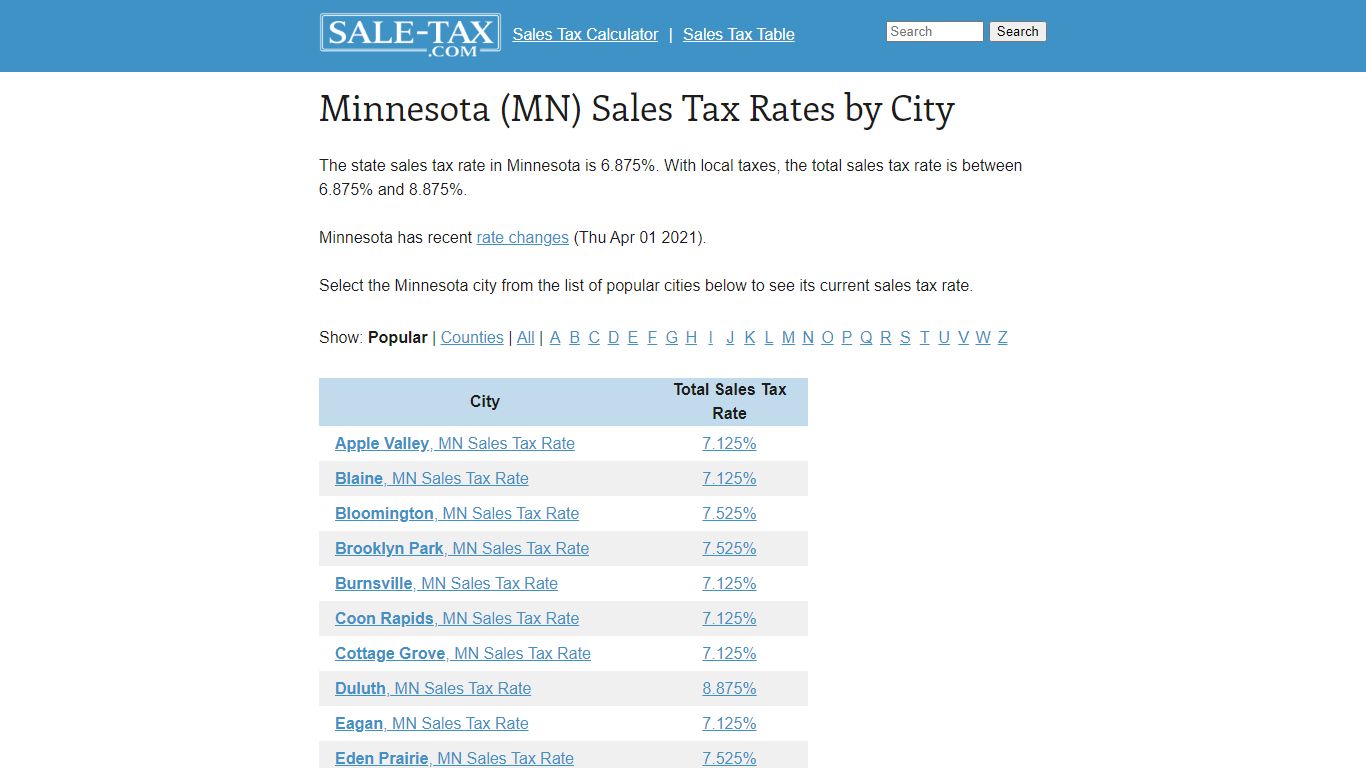

Minnesota (MN) Sales Tax Rates by City - Sale-tax.com

Sales Tax Calculator | Sales Tax Table The state sales tax rate in Minnesota is 6.875%. With local taxes, the total sales tax rate is between 6.875% and 8.875%.

https://www.sale-tax.com/Minnesota

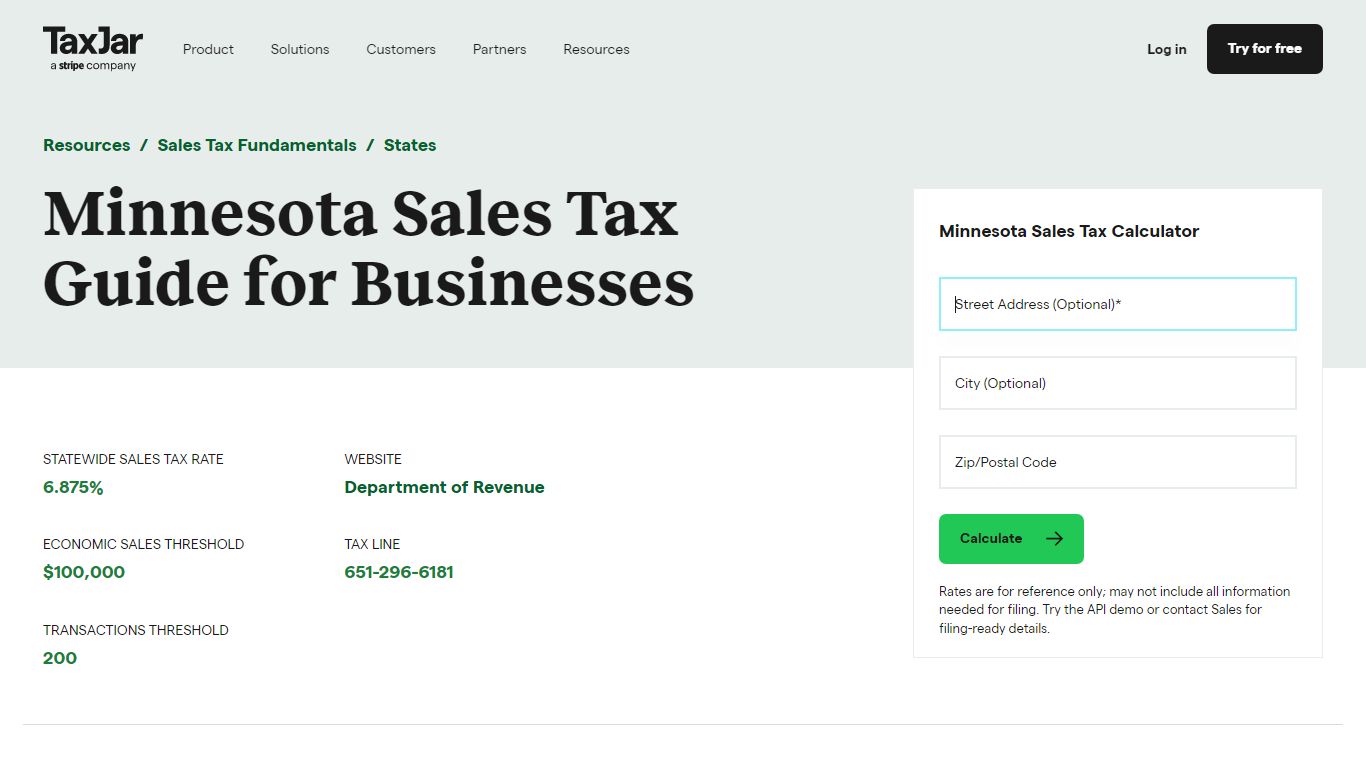

Minnesota Sales Tax Guide and Calculator 2022 - TaxJar

You may register for a Minnesota tax ID number online at Minnesota e-Services. You may register with a paper form here. You may register by telephone by calling 651-282-5225 or 1-800-657- 3605. You need this information to register for a sales tax permit in Minnesota: Your Federal employer ID number (FEIN), if applicable.

https://www.taxjar.com/sales-tax/minnesota

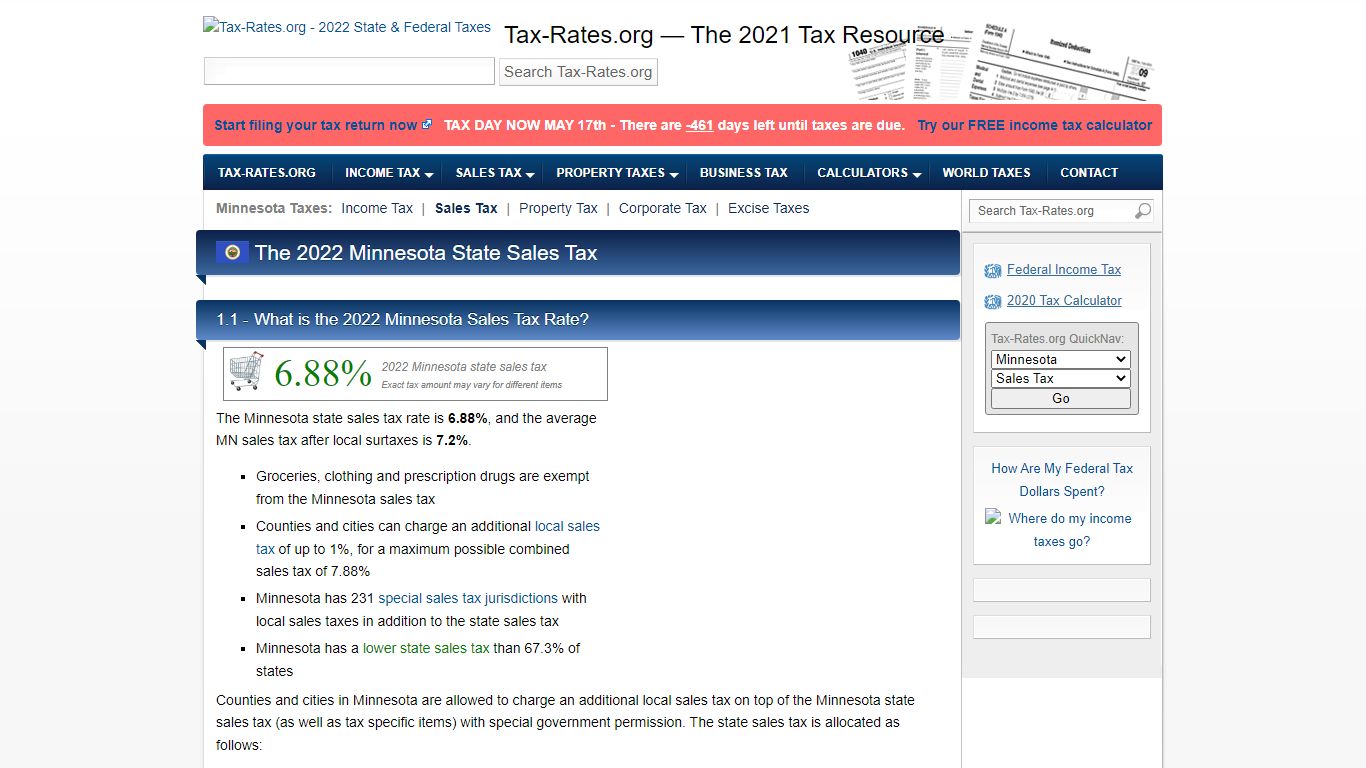

Minnesota Sales Tax Rate - 2022

The Minnesota state sales tax rate is 6.88%, and the average MN sales tax after local surtaxes is 7.2%.. Groceries, clothing and prescription drugs are exempt from the Minnesota sales tax; Counties and cities can charge an additional local sales tax of up to 1%, for a maximum possible combined sales tax of 7.88%; Minnesota has 231 special sales tax jurisdictions with local sales taxes in ...

https://www.tax-rates.org/minnesota/sales-tax

Local Sales Tax Information | Minnesota Department of Revenue

Sales Tax API (Application Program Interface) Description. Connects an online retailer's sales site and Minnesota's sales tax rate information using a nine-digit ZIP code. Name. Rates and Boundaries Files. Description. Get files to program rates into your point-of-sale system from the Streamlined Sales Tax website.

https://www.revenue.state.mn.us/local-sales-tax-information